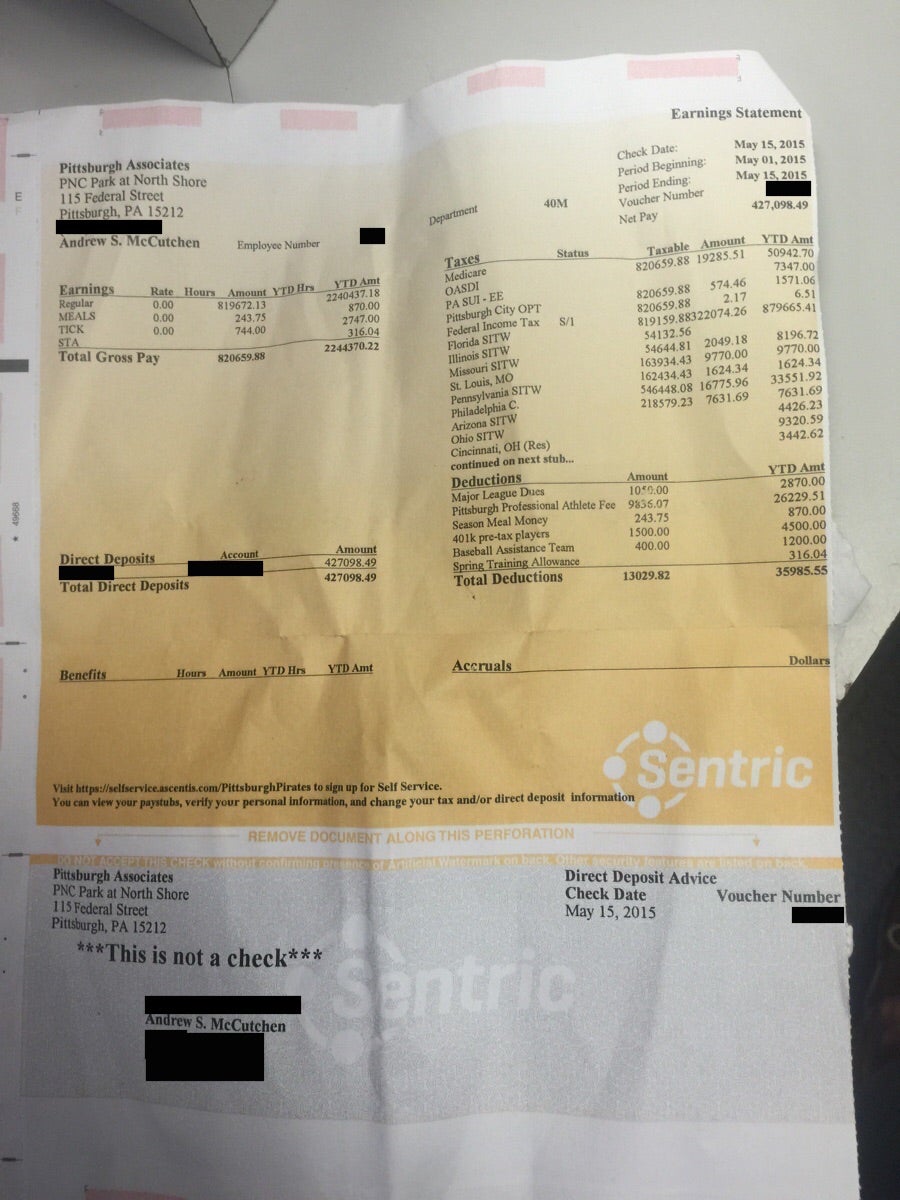

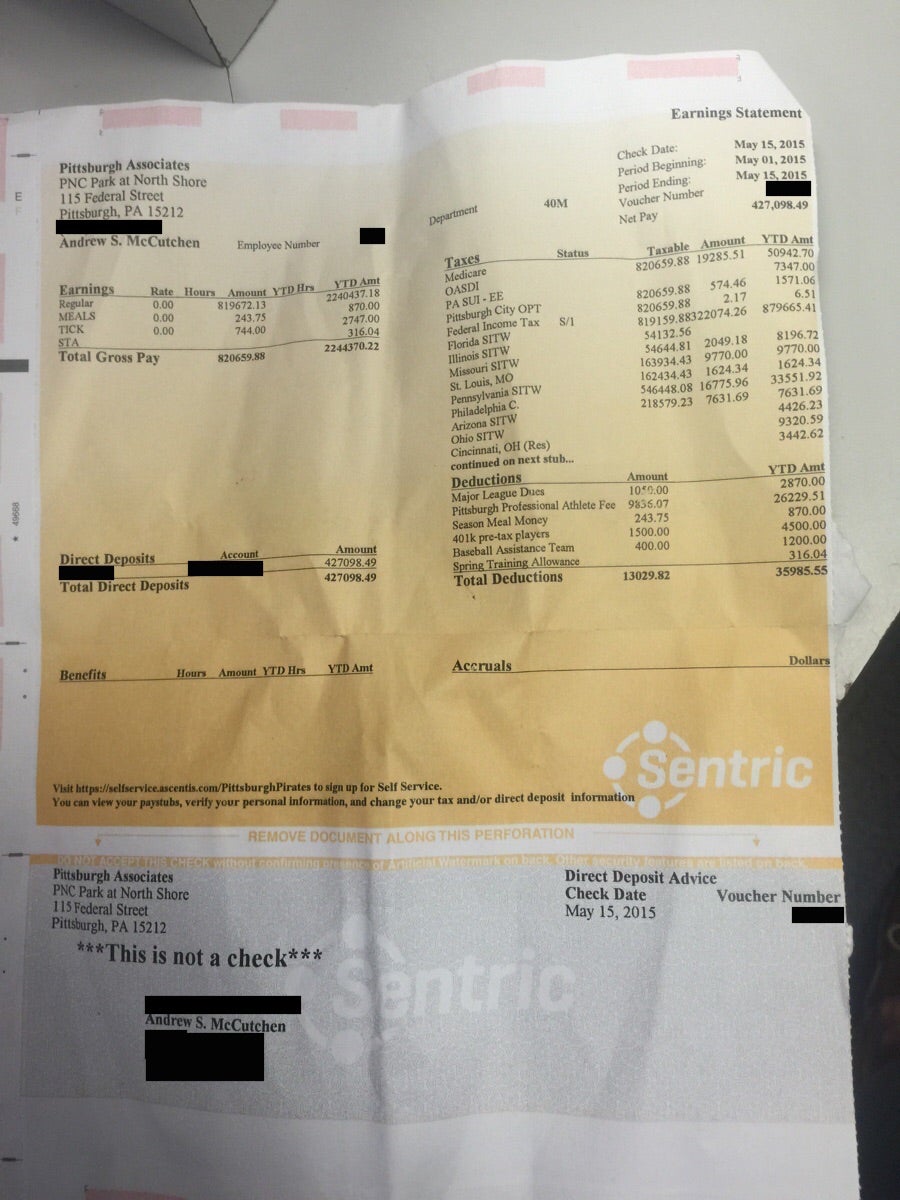

Here's Andrew McCutcheons. Fucking taxes. Thanks Obama.

| Chicago Fanatics Message Board https://mail.chicagofanatics.com/ |

|

| Ever wonder what a mlb players pay stub looks like? https://mail.chicagofanatics.com/viewtopic.php?f=92&t=94126 |

Page 1 of 1 |

| Author: | badrogue17 [ Sat May 23, 2015 7:09 pm ] |

| Post subject: | Ever wonder what a mlb players pay stub looks like? |

Here's Andrew McCutcheons. Fucking taxes. Thanks Obama.

|

|

| Author: | Nas [ Sat May 23, 2015 9:51 pm ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

Looks great. Is $1500 the cap for 401k before you have to pay taxes? What is a professional athlete fee? |

|

| Author: | Spaulding [ Sat May 23, 2015 10:17 pm ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

Holy crap. |

|

| Author: | IMU [ Sat May 23, 2015 10:27 pm ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

denisdman wrote: Looks normal to me.

|

|

| Author: | pittmike [ Sat May 23, 2015 10:35 pm ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

1% er. |

|

| Author: | badrogue17 [ Sat May 23, 2015 11:15 pm ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

IMU wrote: denisdman wrote: Looks normal to me. |

|

| Author: | sinicalypse [ Sun May 24, 2015 1:48 am ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

NSJ wrote: Fucking peasants... Nas wrote: Pfft..... you didn't have to find my W2 forms!

|

|

| Author: | IkeSouth [ Sun May 24, 2015 7:15 am ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

huh... you know, looking at money in the form of numbers like that does make it feel like it doesnt mean much. id probably ask for my paychecks in suitcases full of 20's |

|

| Author: | bigfan [ Sun May 24, 2015 8:43 am ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

Got to pay the agent too! |

|

| Author: | badrogue17 [ Sun May 24, 2015 10:56 am ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

Nas wrote: Looks great. Is $1500 the cap for 401k before you have to pay taxes? What is a professional athlete fee? Dunno if this explains it but this is what I found. Athletes file taxes not only in their home state but also in every state—and some cities—in which they play. Not every state uses the same calculation to determine what portion of an athlete’s income to tax, and some use different calculations based on the sport. For example, Pennsylvania taxes baseball, basketball and hockey players on the ratio games in the state over total games played, including pre- and postseason, but they tax football players based on days worked in the state over total days worked. Michigan uses the same method but excludes the preseason. Most other states use the days worked method. Reciprocity agreements can save an athlete thousands if their tax professional knows what to look for. For example, a Pennsylvania resident whose tax rate is 3.07% is exempt from paying taxes on money earned in New Jersey (8.97% tax rate), West Virginia (6.5%), Ohio (5.925%), Maryland (5.75%), Virginia (5.75%) and Indiana (3.4%). Because players come from all over and move around so much an athlete’s team will often times report income and withhold taxes in every state he plays, regardless of whether a reciprocity agreement with his home state is in place. Taxpayers generally receive credits for taxes paid in other states. Usually, credits are taken on a taxpayer’s home-state return. But residents of Arizona, Indiana, Oregon and Virginia must take credits for taxes paid to California on their California return. Most of time, states will not give credits for taxes paid to cities. However, New Jersey gives people who work in Philadelphia and pay its 3.4985% nonresident wage tax a credit on their New Jersey return. Unlike most of us, athletes can receive millions in signing bonuses. These bonuses are exempt from most states’ taxes if they are paid separately from salary, non-refundable and also not contingent upon playing for the team. So if Mario Williams’ contract was written properly, the Texas resident would not have to pay a dime in taxes to New York (or any other state) on the $19 million signing bonus he received when he signed with the Bills last summer, a tax savings of $1.676 million. It is a safe bet that Buffalo’s payroll department allocated the bonus to New York and the other states in which the Bills played. It is up to his tax advisor to catch it and make the necessary adjustment. Finally, athletes get docked with hidden taxes in various jurisdictions. Tennessee hits basketball and hockey players with a $2,500 per game tax (max 3 games per year). Pittsburgh gets athletes for 3% of their wages for games played there. Although deductible on Schedule A of the federal return, neither of these taxes shows up on the player’s W-2. The tax preparer needs to have the player’s year-end paystub, where those and other deductions are often found. Many teams also mistakenly withhold Pittsburgh’s 1% wage tax. This tax is only imposed on Pittsburgh residents, so a refund request must be filed with the city to reclaim that money. – |

|

| Author: | Spaulding [ Mon May 25, 2015 12:19 am ] |

| Post subject: | Re: Ever wonder what a mlb players pay stub looks like? |

IkeSouth wrote: huh... you know, looking at money in the form of numbers like that does make it feel like it doesnt mean much. id probably ask for my paychecks in suitcases full of 20's No, we'd redistribute your money. |

|

| Page 1 of 1 | All times are UTC - 6 hours [ DST ] |

| Powered by phpBB® Forum Software © phpBB Group https://www.phpbb.com/ |

|